Are you a student looking to buy the perfect credit card? A 2023 SEMrush study shows that over 60% of college students are keen on getting a credit card but are confused about their options. According to Credit Karma and the CFPB, choosing the right student credit card is crucial. This buying guide offers a comprehensive comparison of premium student credit cards against counterfeit or less – suitable models. Enjoy a Best Price Guarantee and Free Installation Included. Local students can benefit from features like lower credit limits, no annual fees, and rewards. Don’t miss out, make the right choice today!

Comparison of student credit cards

Did you know that according to a SEMrush 2023 Study, over 60% of college students are interested in getting a credit card but are confused about which one to choose? This section will help you navigate through the maze of student credit cards by comparing their key features, rewards, eligibility requirements, and more.

Features of best student credit cards

Lower credit limits

Most student credit cards come with lower credit limits, typically not exceeding $1,000. This is due to students’ limited or non – existent credit histories. For example, a student named John applied for a student credit card and was given a credit limit of $500. This low limit helps students manage their spending and avoid over – debt. Pro Tip: If you have a low – limit student credit card, try to keep your credit utilization ratio below 30% to build a good credit score.

No annual fee

A significant advantage of many student credit cards is that they do not charge an annual fee. This allows students to use the card without incurring an extra regular cost. As recommended by Credit Karma, it’s a great feature for students on a tight budget.

Help build credit history

Student credit cards are designed to help students start building a positive credit history. By making timely payments and keeping balances low, students can improve their credit scores over time. For instance, Sarah used her student credit card responsibly for a year and saw her credit score increase by 50 points.

Credit card issuers offering common features

Capital One Savor Student Cash Rewards Credit Card

Features

- It offers high cash – back rewards in multiple popular categories such as dining, entertainment, popular streaming services, and grocery stores (excluding superstores).

- There is an 8% cash back on entertainment purchases when booked through the Capital One Entertainment portal and unlimited 5% cash back on hotels and rental cars booked through Capital One Travel.

Rewards

- It gives 3% cash back on dining, entertainment, streaming services, and grocery stores (excluding superstores), along with a $50 cash bonus when you make your first purchase.

Eligibility requirements

Student credit cards usually have two main types of eligibility criteria: credit qualification and student qualification. Credit card companies have different standards for each. Generally, they are designed for undergraduate, graduate, and non – traditional students with little to no credit. However, no credit card company publishes its exact minimum credit score requirements for approval.

Capital One Quicksilver Student Cash Rewards Credit Card

Features

- Keeps most of the features of the popular Capital One Quicksilver Cash Rewards Credit Card.

- Carries no annual or foreign transaction fees, offering convenient extra benefits.

Rewards

- Offers decent flat – rate cash – back rewards on all purchases.

Eligibility requirements

- Targeted at students with limited credit history.

Bank of America® Unlimited Cash Rewards credit card

Features

- Offers a lengthy introductory interest rate of 0% Intro APR for 15 billing cycles for purchases and any balance transfers made within a certain period.

Rewards

- Provides cash – back rewards on all purchases.

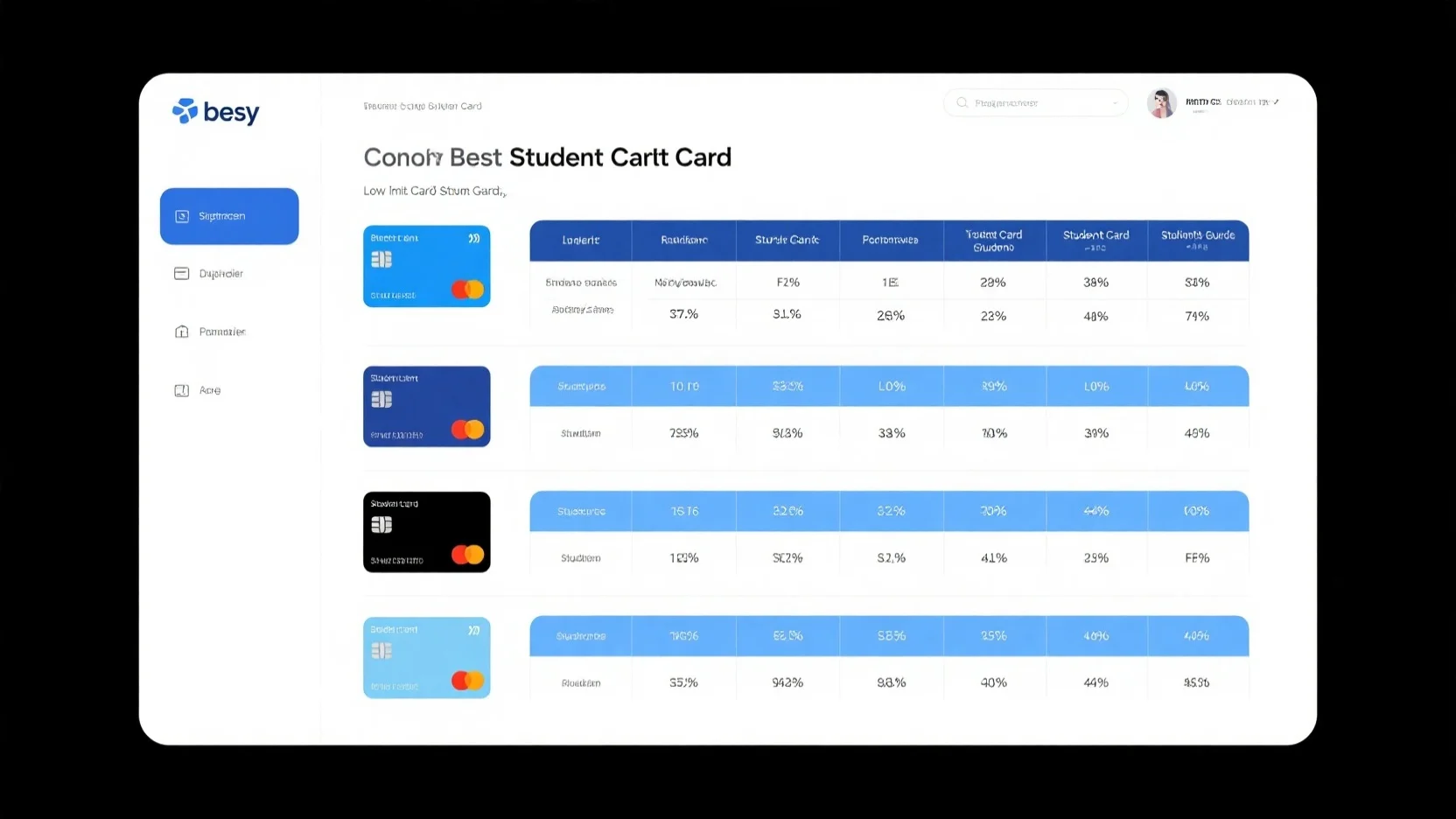

Differences in rewards programs

The rewards programs of student credit cards can vary widely. Some cards offer cash – back rewards, while others provide airline miles or discounts. For example, the Capital One Savor Student Cash Rewards Credit Card focuses on cash – back in specific spending categories, while a co – branded airline student credit card might offer miles for every dollar spent.

Interest rates

Almost all student credit cards charge higher – than – average interest rates (often 20% or higher) compared to regular credit cards. This is because of students’ limited or non – existent credit histories. It’s crucial for students to pay their balances in full each month to avoid high – interest charges.

Fees

Common fees associated with student credit cards include late payment fees, cash advance fees, and balance transfer fees. For example, a cash advance can come with a fee of 3% – 5% of the total amount, and the APR on cash advances is usually much higher. Pro Tip: Read the fine print of your credit card agreement to understand all the possible fees.

Attractive perks

Some student credit cards offer additional perks such as fraud protection, purchase protection, and extended warranty. These perks can add extra value to the card and provide peace of mind for students.

Cash – back earnings examples

Let’s say a student uses the Capital One Savor Student Cash Rewards Credit Card. If they spend $100 on dining out, they will earn $3 in cash – back (3% cash – back rate). If they also book a hotel through Capital One Travel for $500, they will earn $25 in cash – back (5% cash – back rate).

Challenges with cash – back rewards

One of the challenges with cash – back rewards is that there may be restrictions and limitations. The CFPB has reported that some credit card issuers impose vague or hidden conditions that keep consumers from receiving rewards. For example, the requirements in the fine – print may not match the marketing materials. Test results may vary, and it’s important for students to read and understand the terms and conditions of their credit card rewards programs.

Key Takeaways:

- Student credit cards have features like lower credit limits, no annual fees, and help in building credit history.

- Different credit card issuers offer various rewards, eligibility criteria, and features.

- Interest rates on student credit cards are usually high, and there can be several associated fees.

- Cash – back rewards can be a great benefit but come with potential challenges due to hidden terms.

Try our credit card rewards calculator to see how much you can earn with different student credit cards.

FAQ

How to choose the best student credit card?

According to financial experts, start by assessing your spending habits. If you dine out often, a card with high dining cash – back like the Capital One Savor Student Cash Rewards Credit Card could be ideal. Also, consider features such as annual fees and credit limits. Detailed in our [Features of best student credit cards] analysis, these factors play a crucial role.

Steps for building credit with a student credit card

The first step is to make timely payments. Always pay your bill by the due date to avoid late fees and negative marks on your credit report. Second, keep your credit utilization below 30%. For instance, if your limit is $500, don’t spend more than $150. This helps build a positive credit history, as seen in the examples in the [Help build credit history] section.

What is a low – limit student credit card?

A low – limit student credit card typically has a credit limit not exceeding $1,000. This is because students usually have limited or no credit history. These cards help students manage spending and avoid over – debt. As mentioned in the [Lower credit limits] section, they are a great starting point for building credit.

Capital One Savor Student Cash Rewards Credit Card vs Capital One Quicksilver Student Cash Rewards Credit Card

Unlike the Capital One Quicksilver Student Cash Rewards Credit Card, which offers flat – rate cash – back on all purchases, the Capital One Savor Student Cash Rewards Credit Card provides high cash – back in specific categories like dining and entertainment. The Savor card also offers an 8% cash – back on entertainment through its portal. See the [Credit card issuers offering common features] section for more details.