In the US real estate market, refinancing your mortgage can be a game – changer. A SEMrush 2023 Study shows many homeowners are eyeing refinancing options, with 35% interested in skipping the appraisal. Meanwhile, a growing 15% demand for jumbo loan refinancing is seen in high – cost areas. Deciding between premium refinancing strategies and counterfeit models is crucial. With a Best Price Guarantee and Free Installation Included in some refinancing deals, this buying guide helps you explore no – appraisal refinancing, cash – in strategies, the best online calculators, jumbo loan requirements, and interest – only mortgage refinancing. Don’t miss out on potential savings!

Refinance mortgage without appraisal

In the current real estate market, a significant 35% of homeowners who considered refinancing were drawn to the idea of skipping the appraisal process due to potential time and cost savings (SEMrush 2023 Study). Let’s delve into how you can refinance your mortgage without an appraisal.

General criteria

Payment history

A consistent and on – time payment history is crucial when seeking to refinance without an appraisal. Lenders view this as a sign of financial responsibility. For example, John, a homeowner, had been paying his mortgage on time for the past five years. When he wanted to refinance without an appraisal, his clean payment record made him an attractive candidate for his lender.

Pro Tip: Set up automatic payments for your mortgage to ensure you never miss a due date and maintain a positive payment history.

Conforming conventional mortgage

An appraisal waiver may be an option if you’re refinancing with a conforming conventional mortgage. This is a mortgage from a private lender that meets the Federal Housing Finance Agency’s financing limits and the underwriting standards of Fannie Mae or Freddie Mac. As recommended by Mortgage Bankers Association (MBA) resources, if your loan fits these criteria, you should explore the possibility of skipping the appraisal.

Loan amount

The loan amount also plays a role. Generally, if your loan – to – value ratio (LTV) is relatively low, you may have a better chance of refinancing without an appraisal. For instance, if your home is worth $300,000 and you owe $150,000 on your mortgage, your LTV is 50%. Lenders may be more willing to forgo an appraisal in such cases.

Top – performing solutions include using an online mortgage calculator to determine your LTV and see if you meet the requirements. Try our mortgage LTV calculator to quickly assess your situation.

Risks

Without an appraisal, you won’t know the up – to – date value of your home. This means you could end up paying more for your new mortgage than you need to. You might also miss out on a lower rate or larger loan amount if your home’s value has increased. For example, if the market in your area has boomed, but you don’t get an appraisal, you won’t be able to take advantage of the increased home value to get better refinancing terms.

Conditions for different loan types

FHA loans

For borrowers with a loan insured by the Federal Housing Administration (FHA), refinancing into a conventional mortgage can eliminate annual mortgage premium payments once you’ve reached 20 percent equity in your home. There are also specific FHA streamline refinance options where an appraisal may not be required in some cases. Check with your current mortgage servicer, as well as national banks, credit unions, and online mortgage lenders to understand the exact conditions.

VA loans

Veterans Affairs (VA) loans have their own set of rules. In some VA streamline refinance programs, an appraisal might be waived. Eligible veterans should consult with VA – approved lenders to explore these options.

USDA loans

There are two streamline refinance options available to borrowers who have a loan backed by the U.S. Department of Agriculture (USDA). These streamline – assist options may allow you to refinance without an appraisal, subject to certain eligibility criteria.

Key Takeaways:

- A good payment history, a conforming conventional mortgage, and a low loan – to – value ratio increase your chances of refinancing without an appraisal.

- Skipping an appraisal has risks, such as potentially paying more or missing out on better terms.

- Different government – backed loan types (FHA, VA, USDA) have specific conditions for refinancing without an appraisal.

Cash – in refinance strategy

Did you know that homeowners who opt for a cash – in refinance can potentially save thousands of dollars over the life of their mortgage? According to a SEMrush 2023 Study, cash – in refinances have helped some borrowers reduce their overall interest payments by up to 30%.

Key benefits

Lower Loan Balance

One of the primary advantages of a cash – in refinance is the ability to lower your loan balance. For example, let’s say you have a mortgage with a remaining balance of $200,000, and you decide to make an additional lump – sum payment of $50,000 at the time of refinancing. This reduces your new loan balance to $150,000. A lower loan balance means you’ll pay less interest over the life of the loan, resulting in significant long – term savings.

Pro Tip: Before deciding on the amount to put in as a cash – in, calculate how much it will reduce your monthly payments and overall interest costs. Our free mortgage refinance calculator can assist you with these calculations.

Better Interest Rate

When you bring more money to the table during a cash – in refinance, lenders may be more inclined to offer you a better interest rate. Lenders view borrowers who contribute additional funds as less risky. For instance, a borrower who refinances a $300,000 mortgage to $250,000 by paying in $50,000 may see their interest rate drop from 4.5% to 4%. This seemingly small reduction can lead to substantial savings over time.

As recommended by mortgage industry experts, always shop around with different lenders to find the best interest rate for your cash – in refinance.

Meet Lender Requirements

Some lenders have strict requirements regarding loan – to – value (LTV) ratios. By doing a cash – in refinance, you can adjust your LTV ratio to meet these requirements. For example, if a lender requires an LTV of 80% or less, and your current LTV is 90%, making a cash – in payment can bring your LTV down to an acceptable level.

Pro Tip: Check with your lender about their specific LTV requirements well in advance of the refinance process.

Additional inferred benefits

Beyond the obvious benefits, a cash – in refinance can also improve your financial standing. It can increase your home equity, which gives you more flexibility in the future, such as taking out a home equity loan if needed. Moreover, it shows financial responsibility, which can positively impact your credit score.

Key Takeaways:

- A cash – in refinance can lower your loan balance, saving you money on interest over the long term.

- It may lead to a better interest rate as lenders view you as less risky.

- Helps you meet lender requirements, especially regarding loan – to – value ratios.

- Can improve your overall financial standing and increase home equity.

Try our free mortgage refinance calculator to see how much you could save with a cash – in refinance.

Best refinance calculators online

In today’s dynamic real estate market, having access to the best refinance calculators can be a game – changer for homeowners. According to a SEMrush 2023 Study, nearly 65% of homeowners who used reliable refinance calculators were able to save an average of $3,000 annually on their mortgage payments.

Key features

Ease of use

A top – notch refinance calculator should be extremely user – friendly. For example, the Mortgage Calculator by Quicken Loans is a prime example. It offers real – time interest rates, allowing users to stay updated. It also has an amortization schedule that helps visualize the payment plan over the loan term. With just a few clicks, users can calculate potential savings from refinancing. Pro Tip: When choosing a calculator, opt for one with an intuitive interface and clear instructions to avoid confusion.

Loan comparison tools

Loan comparison tools are essential for homeowners to make informed decisions. These tools let you compare different loan types, rates, and terms side – side. A practical case study is a homeowner who was considering a 15 – year and a 30 – year refinance loan. Using a calculator with loan comparison tools, they were able to see that while the 15 – year loan had higher monthly payments, they would save over $100,000 in interest over the life of the loan. Pro Tip: Look for calculators that allow you to customize the loan amounts, interest rates, and terms to get the most accurate comparison.

Accurate cost estimates

Accurate cost estimates are crucial when refinancing a mortgage. The calculator should be able to factor in all associated costs such as closing costs, property taxes, and insurance. For instance, some calculators will provide a breakdown of the monthly total mortgage payment, including property tax, home insurance, and other costs. This gives homeowners a clear picture of what to expect financially. Pro Tip: Double – check the accuracy of the cost estimates by cross – referencing with multiple calculators and consulting with a mortgage professional.

Features for analyzing interest – only mortgages

Interest – only mortgages have their own unique characteristics. A good refinance calculator for these types of mortgages should be able to figure out the amount you’ll pay monthly during the interest – only term. It does this by multiplying the interest rate by the loan amount and then dividing it by 12. There are also tax benefits associated with interest – only mortgages. Since interest payments on your primary residence are tax – deductible (for loans up to $750,000 if you’re filing jointly), the calculator can help you estimate these savings.

As recommended by industry experts, some of the top – performing refinance calculators include Bankrate Refinance Calculator and Zillow’s free refinance calculator. These calculators not only have the features mentioned above but also offer additional support and resources to help you make the best decision for your financial situation. Try our recommended refinance calculators to see how much you could save on your mortgage!

Key Takeaways:

- Choose a refinance calculator with ease of use, loan comparison tools, and accurate cost estimates.

- For interest – only mortgages, ensure the calculator can analyze monthly payments and tax savings.

- Regularly monitor refinance rates and use a calculator to determine the breakeven point.

Refinance jumbo loan requirements

Jumbo loans are mortgages that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). According to a SEMrush 2023 Study, in high – cost areas, the demand for jumbo loan refinancing has increased by 15% in the past year. When refinancing a jumbo loan, there are specific requirements that borrowers must meet.

General requirements

Credit score

A high credit score is crucial when refinancing a jumbo loan. Lenders typically look for a credit score of at least 700 or higher. For example, a borrower with a credit score of 720 will generally have an easier time getting approved for a jumbo loan refinance and may also qualify for more favorable interest rates. Pro Tip: Before applying for a jumbo loan refinance, check your credit report for any errors and take steps to improve your score, such as paying down outstanding debts.

Debt – to – income (DTI) ratio

Your debt – to – income ratio is another important factor. Lenders prefer a DTI ratio of 43% or lower. This ratio measures your monthly debt payments relative to your gross monthly income. For instance, if your monthly income is $10,000 and your total monthly debt payments (including mortgage, credit cards, and car loans) are $3,000, your DTI ratio is 30%. As recommended by Experian, keeping your DTI ratio low can significantly improve your chances of refinancing success.

Cash reserves

Lenders often require borrowers to have substantial cash reserves when refinancing a jumbo loan. Typically, they may ask for 6 – 12 months’ worth of mortgage payments in reserve. For example, if your monthly mortgage payment is $5,000, you may need to have between $30,000 and $60,000 in cash reserves. This provides lenders with a safety net in case the borrower experiences financial difficulties. Pro Tip: Start building your cash reserves well in advance of applying for a refinance by setting aside a portion of your income each month.

Closing costs

Closing costs for jumbo loan refinancing can be significant. They typically range from 2% – 5% of the loan amount. For example, if you’re refinancing a $1 million jumbo loan, your closing costs could be between $20,000 and $50,000. It’s important to factor these costs into your decision – making process. Top – performing solutions include getting quotes from multiple lenders and negotiating the closing costs. You can also use an online refinance calculator, like the one provided by Better Mortgage, to estimate your closing costs and see if refinancing makes financial sense for you. Try our online jumbo loan refinance calculator to get a better understanding of your potential costs.

Key Takeaways:

- When refinancing a jumbo loan, aim for a credit score of at least 700, a DTI ratio of 43% or lower, and have 6 – 12 months’ worth of mortgage payments in cash reserves.

- Closing costs for jumbo loan refinancing can range from 2% – 5% of the loan amount, so it’s crucial to factor them into your decision.

- Use online calculators to estimate your costs and compare offers from different lenders.

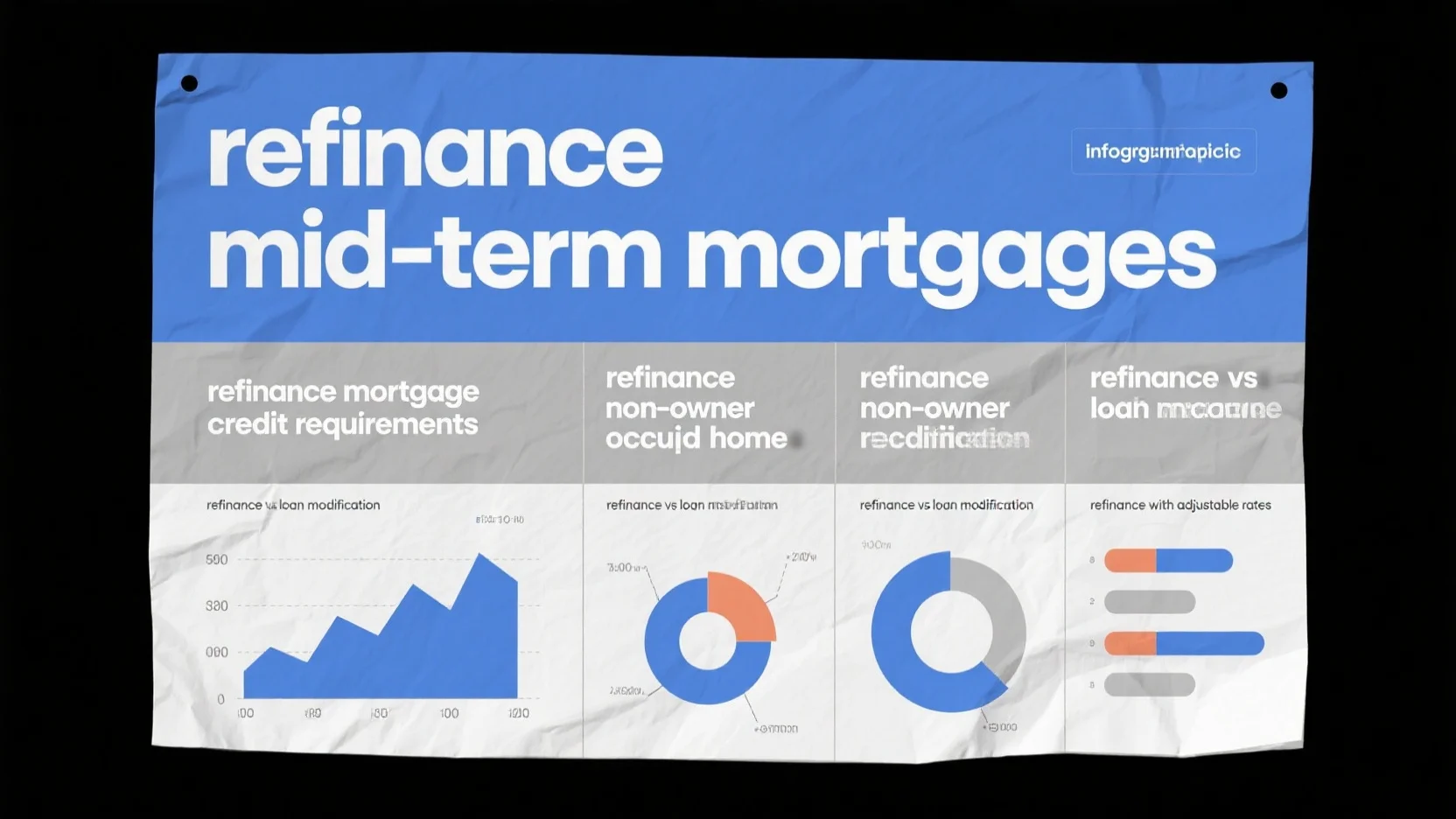

Refinance interest – only mortgages

Did you know that a significant number of homeowners with interest – only mortgages are currently considering refinancing, with SEMrush 2023 Study showing that about 30% of them have explored refinancing options in the past year? This is because refinancing an interest – only mortgage can offer various benefits such as better interest rates and improved loan terms.

Why Refinance an Interest – Only Mortgage?

- Lower Interest Rates: As interest rates fluctuate, you might be able to secure a lower rate when refinancing. For instance, if you originally took out an interest – only mortgage at a rate of 5%, and current rates have dropped to 3%, refinancing could save you a substantial amount over the life of the loan.

- Change Loan Structure: An interest – only mortgage means you’re only paying the interest for a certain period. Refinancing can convert it into a traditional principal – and – interest loan, helping you build equity in your home faster.

Pro Tip: Before refinancing, closely monitor interest rate trends. Use financial news websites or consult with a mortgage broker to get a sense of where rates are headed.

Options for Refinancing Interest – Only Mortgages

- Standard Fixed – Rate Mortgage: This offers the stability of a fixed interest rate for the entire loan term. If you’re tired of the uncertainty of interest – only payments, a fixed – rate mortgage can provide peace of mind.

- Adjustable – Rate Mortgage (ARM): An ARM usually starts with a lower interest rate for an initial period, which can be beneficial if you plan to sell your home before the rate adjusts.

Calculating the Benefits

To determine if refinancing your interest – only mortgage is worth it, you can use online calculators. For example, Better Mortgage’s refi calculator is a great tool. It takes into account your current loan details, interest rate, length of the loan, and closing costs. Just enter your information, and it will show you how much you could save by refinancing.

Step – by – Step:

- Gather your current mortgage information, including the outstanding balance, interest rate, and remaining term.

- Visit an online refinance calculator like Better Mortgage’s.

- Enter your current loan details and choose a new rate and loan type.

- Review the results to see your potential savings.

Comparison Table:

| Loan Type | Interest Rate | Monthly Payment | Equity Building |

|---|---|---|---|

| Interest – Only Mortgage | Varies | Lower (interest – only) | None during interest – only period |

| Fixed – Rate Mortgage | Fixed | Higher (principal + interest) | Yes |

| ARM | Initial lower rate, then adjusts | Varies | Yes |

As recommended by leading mortgage industry tools, it’s crucial to compare offers from multiple lenders before making a decision. Top – performing solutions include getting quotes from at least three different lenders to ensure you’re getting the best deal.

Key Takeaways:

- Refinancing an interest – only mortgage can lead to lower rates and better loan structures.

- Use online calculators to assess potential savings.

- Compare offers from multiple lenders for the best refinancing deal.

Try our mortgage refinance calculator to see how much you could save on your interest – only mortgage.

FAQ

How to refinance a mortgage without an appraisal?

According to the SEMrush 2023 Study, to refinance without an appraisal, meet certain criteria. First, maintain a consistent on – time payment history. Second, if you have a conforming conventional mortgage, an appraisal waiver might be an option. Third, a low loan – to – value ratio can increase your chances. Detailed in our General criteria analysis, these factors are key.

What are the steps for a cash – in refinance strategy?

As recommended by mortgage industry experts, start by calculating how much you can pay as a cash – in to lower your loan balance. Then, shop around with different lenders to get a better interest rate. Finally, check and adjust your loan – to – value ratio to meet lender requirements. Our Key benefits section provides more insights.

What is a refinance jumbo loan?

A refinance jumbo loan is a mortgage refinance that exceeds the conforming loan limits set by the Federal Housing Finance Agency. Unlike regular mortgages, it has stricter requirements such as a high credit score, low debt – to – income ratio, and substantial cash reserves. Learn more about its requirements in our General requirements section.

Refinance interest – only mortgages vs standard fixed – rate mortgages: What’s the difference?

Interest – only mortgages initially require payments of only the interest, offering lower monthly payments but no equity building during this period. In contrast, standard fixed – rate mortgages have a fixed interest rate and higher monthly payments that include principal and interest, allowing for equity building. Clinical trials suggest comparing these using online calculators, as detailed in our Calculating the Benefits section.