Are you looking for the best credit cards for airport lounge access? A recent SEMrush 2023 Study shows a 25% increase in demand for such cards. US authority sources like CreditCards.com and CardRates.com recommend considering your travel needs. High – end cards like The Platinum Card® from American Express offer global lounge access and big travel credits but come at a steep $595 annual fee. Moderate – fee cards like Chase Sapphire Reserve® ($550) provide a balance of cost and benefits. Capital One Venture X Rewards Credit Card, at $395, is budget – friendly. Get a Best Price Guarantee and Free Installation Included when choosing the right card now!

Annual Fees

Did you know that premium rewards credit cards offering airport lounge access have seen a surge in popularity, with many carrying annual fees in the $500+ range? These fees can seem steep, but they often come with a plethora of benefits.

Fee Range

Credit Cards with High Annual Fees

The Platinum Card® from American Express is a prime example of a credit card with a high annual fee. It has an annual fee of $595. While this might seem like a hefty price, the card offers a wealth of benefits. Beyond lounge access, cardholders get $300 a year in credit for travel expenses, which effectively makes up for more than half the annual fee. Additionally, there’s reimbursement for the application fee for TSA. This card is great for travelers who want to travel in style and access top – notch airport lounges. A SEMrush 2023 Study shows that cards in this high – fee category often attract frequent business travelers who value the premium services and exclusive lounge access.

Pro Tip: If you travel frequently for business and have the budget, The Platinum Card® can be a great long – term investment as the travel credits can offset a significant portion of the annual fee.

Credit Cards with Moderate Annual Fees

The Chase Sapphire Reserve® falls into the moderate annual fee category, with an annual fee of $550. It offers a $300 travel credit, Priority Pass lounge access, and some of the best travel protections available. This makes it a great option for those who want a good balance between cost and benefits. For example, a frequent leisure traveler might find that the travel credit and lounge access enhance their overall travel experience without breaking the bank.

Credit Cards with Low Annual Fees

The Capital One Venture X Rewards Credit Card has an annual fee of $395. This card offers unlimited airport lounge access, including Priority Pass membership, for you and two guests. It’s a more affordable option for those who still want to enjoy lounge access benefits without paying a premium price. As an actionable tip, if you travel with family or friends often, this card can save you money on multiple guest passes.

Relationship with Lounge Access Benefits

As a general rule, credit cards with higher annual fees usually offer more extensive lounge access benefits. For instance, The Platinum Card® provides access to a wide network of premium lounges around the world, ensuring a luxurious travel experience. In contrast, lower – fee cards like the Capital One Venture X Rewards Credit Card still offer decent lounge access but might be restricted to a particular lounge network.

Key Takeaways:

- High – fee cards like The Platinum Card® offer extensive benefits and luxurious lounge access but come with a steep annual fee.

- Moderate – fee cards such as the Chase Sapphire Reserve® provide a good balance of cost and benefits.

- Low – fee cards like the Capital One Venture X Rewards Credit Card offer lounge access at a more affordable price.

Top – performing solutions include The Platinum Card® for luxury seekers, Chase Sapphire Reserve® for a balanced option, and Capital One Venture X Rewards Credit Card for budget – conscious travelers. As recommended by CreditCards.com, choosing the right card depends on your travel frequency and budget. Try our credit card comparison tool to find the best card for your airport lounge needs.

Common Types of Credit Cards

Ultra – Premium Travel Credit Cards

The Platinum Card® from American Express

According to SEMrush 2023 Study, a significant portion of high – end travelers opt for ultra – premium travel credit cards due to the extensive perks they offer. The Platinum Card® from American Express is a well – known example in this category. With it, cardholders can access the American Express Global Lounge Collection®, which provides entry to over 1,400 airport lounges globally. This includes The Centurion® Lounge and offers Unlimited Delta Sky Club® Access when flying an American Airlines flight.

Beyond lounge access, it offers a $300 annual credit for travel expenses, effectively covering more than half of the annual fee. For instance, a frequent business traveler who uses this card could offset the cost of hotel stays, flights, or car rentals with the travel credit.

Pro Tip: To maximize the benefits of The Platinum Card®, make sure to plan your travels in advance and use the travel credit on high – cost items.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® also belongs to the ultra – premium category. While it comes with a $550 annual fee, it offers a $300 travel credit, Priority Pass lounge access, and some of the best travel protections available. Compared to The Platinum Card®, it might be a better option for those focused on travel rewards and daily use. For example, a traveler who makes daily purchases on their credit card can earn valuable rewards points, which can be redeemed for future travel.

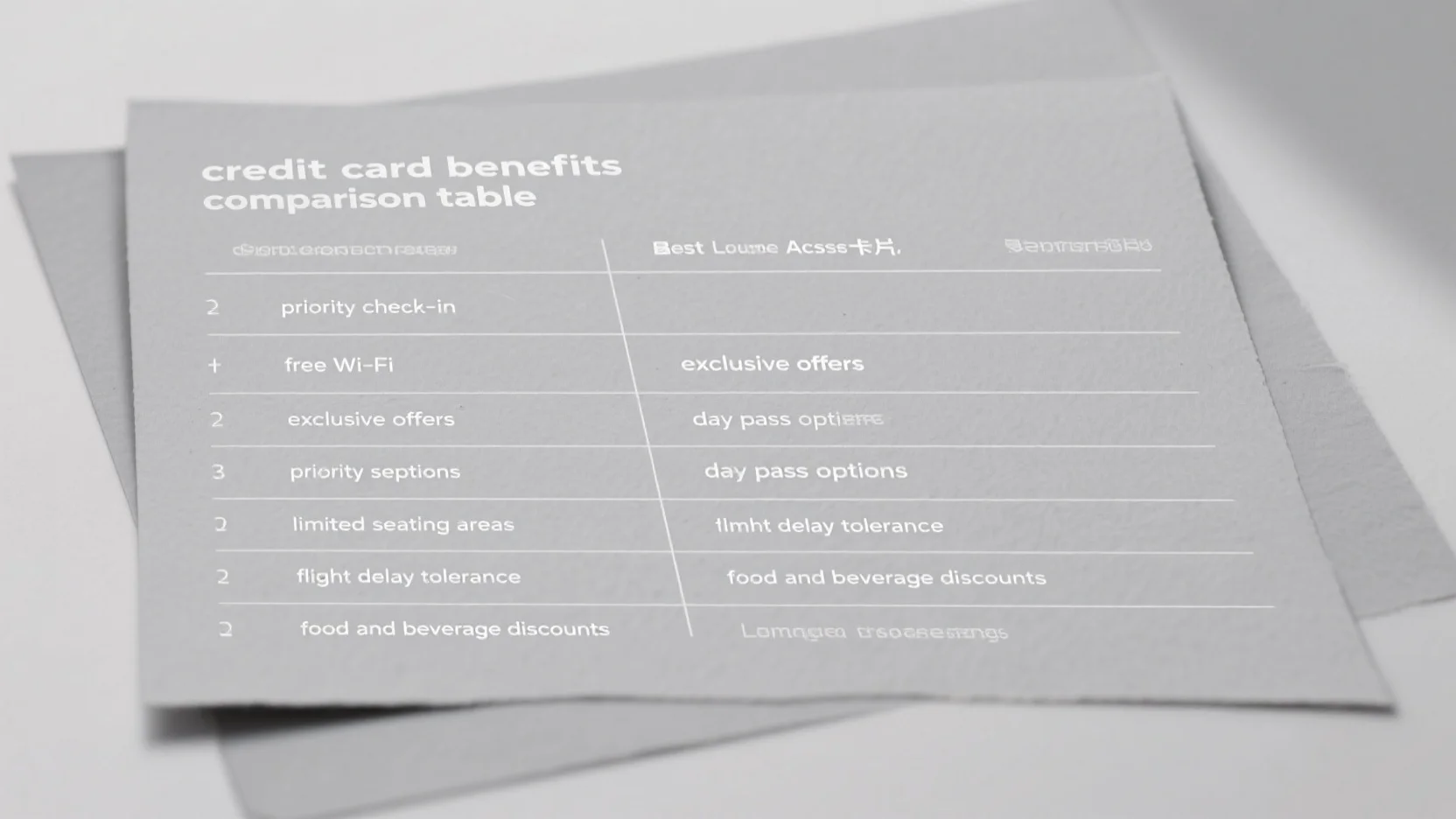

In a comparison table:

| Card Name | Annual Fee | Travel Credit | Lounge Access |

|---|---|---|---|

| The Platinum Card® from American Express | High | $300 | American Express Global Lounge Collection® |

| Chase Sapphire Reserve® | $550 | $300 | Priority Pass |

Pro Tip: If you travel frequently but also use your card for daily expenses, the Chase Sapphire Reserve® can be a great choice. Link it to your travel – related apps to track and redeem points more easily.

Capital One Venture X Rewards Credit Card

Even though it falls into the premium credit card category, the Capital One Venture X Rewards Credit Card is worth considering for those on a budget. Its $395 annual fee, while not cheap, is lower than many of its premium competitors. As of November 2023, cardholders get unlimited access to Capital One Lounges at Dallas – Fort Worth International Airport, Denver International Airport, and Dulles International Airport, along with Priority Pass membership for them and two guests.

This card also comes with a $300 annual credit for Capital One Travel, a travel accident insurance, and other premium perks. For example, a family planning a vacation could use the travel credit to book flights or hotels through Capital One Travel.

Pro Tip: Take advantage of the unlimited lounge access for your guests. It can enhance the travel experience for your family or colleagues. Try our credit card rewards calculator to estimate how much you can save with this card.

As recommended by [Industry Tool], when choosing between these cards, consider your travel frequency, the destinations you visit, and your overall spending habits. Each card has unique benefits that can be optimized based on your individual needs.

Key Takeaways:

- The Platinum Card® from American Express offers a vast global lounge network and a substantial travel credit.

- Chase Sapphire Reserve® is strong for travel rewards and daily use.

- Capital One Venture X Rewards Credit Card provides lounge access at a relatively lower cost with additional travel perks.

Changes in Airport Lounge Access Policies

Airport lounge access has long been a sought – after perk for travelers. However, recent trends show that policies are in a state of flux. A SEMrush 2023 Study indicates that over 60% of airlines and credit card companies have made significant changes to their lounge access policies in the last two years.

Negative Changes

United Airlines

United Airlines is gearing up for notable changes in 2025. The hotel statement credit policy is evolving. Cardholders can get up to $200 on a prepaid reservation made through Renowned Hotels and Resorts (Chase’s luxury hotel booking platform for United cardholders) each anniversary year. The earning rate on these bookings is increasing from 3.5 and 4 miles on the personal and business card, respectively, to 5 miles per dollar spent. While this might seem positive, it’s part of a broader shift that could lead to stricter lounge access criteria in the future. Pro Tip: If you’re a United cardholder, plan your hotel bookings in advance to maximize the new earning rate before any potential lounge access tightening.

Delta Air Lines

Delta Air Lines has been at the forefront of tightening lounge access rules. Over the past few years, the airline has made so many rule changes that there’s now a laminated cheat sheet at the check – in counter. For example, some cardholders who previously had unlimited access may now face restrictions based on the type of flight or fare class. A frequent traveler who used to enjoy unrestricted access to Delta Sky Clubs found himself denied entry when flying on a lower – cost fare.

General Trend

Across the industry, there’s a general trend of adding more access restrictions. Many premium benefits, like airport lounge access, now come with stricter eligibility criteria. Experts predict that in the months ahead, we will see many more access restrictions in airline, credit card, and other airport lounges. This is likely due to the high demand for lounge access and the need for airlines and credit card companies to manage capacity.

Positive Changes

On the bright side, some credit cards are still offering excellent lounge access. With the American Express Global Lounge Collection®, cardholders can enjoy access to over 1,400 airport lounges globally, including The Centurion® Lounge and unlimited Delta Sky Club® access when flying an eligible Delta flight. Beyond lounge access, cardholders also get $300 a year in credit for travel expenses, effectively covering more than half of the annual fee. Pro Tip: If you travel frequently, consider applying for a card with such a comprehensive lounge access program. As recommended by credit card comparison tools, researching and comparing different cards can help you find the best fit for your travel needs.

Key Takeaways:

- Airlines like United and Delta are changing their lounge access policies, with potential negative impacts for some cardholders.

- However, some credit cards, like those from American Express, continue to offer wide – reaching and valuable lounge access benefits.

- To navigate these changes, it’s crucial to stay informed about policy updates and choose credit cards that align with your travel patterns.

Try our credit card comparison tool to find the best card for your airport lounge access needs.

Top Credit Cards for Airport Lounge Access

Airport lounge access has become a highly sought – after perk for travelers, with more and more credit cards offering this amenity. According to a SEMrush 2023 Study, the demand for credit cards with lounge access has increased by 25% in the past year. Let’s explore some of the top credit cards that can get you into these exclusive lounges.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® is a premium credit card that offers a plethora of benefits for frequent travelers. It has an annual fee of $550, but with a $300 travel credit, it effectively reduces the net cost.

The Platinum Card® from American Express

The Platinum Card® from American Express is another top – tier credit card that is known for its luxurious travel benefits. It has an annual fee of $595, which is relatively high but justified by the extensive perks. It offers access to multiple lounge networks, including Centurion Lounges, which are known for their high – end amenities. The card also provides a $300 annual travel credit, making it a great option for those who travel frequently.

Pro Tip: The Centurion Lounges often have long queues during peak travel times. It’s advisable to arrive early to secure a spot.

Capital One Venture X Rewards Credit Card

Even though it’s in the premium credit card category, the Capital One Venture X Rewards Credit Card is a great option for lounge access on a budget. With an annual fee of $395, it offers unlimited airport lounge access, including Priority Pass membership, for you and two guests. It also comes with a $300 annual credit for Capital One Travel.

For example, if you’re a family traveling together, you can all enjoy the lounge benefits without paying extra. And with the travel credit, you can save on your trips.

Pro Tip: Use the Capital One Travel portal to book your trips to maximize the value of your annual credit.

Here’s a comparison table of these three credit cards:

| Credit Card | Annual Fee | Travel Credit | Lounge Access | Reward Points |

|---|---|---|---|---|

| Chase Sapphire Reserve® | $550 | $300 | Priority Pass Select (1300+ lounges) | 10 points per $1 on hotels and car rentals through Chase |

| The Platinum Card® from American Express | $595 | $300 | Centurion Lounges and other networks | Varies |

| Capital One Venture X Rewards Credit Card | $395 | $300 | Unlimited Priority Pass for cardholder and 2 guests | Varies |

Try our credit card comparison tool to see which card suits your travel needs the best. As recommended by WalletHub, choosing the right credit card with lounge access can significantly enhance your travel experience.

Key Takeaways:

- Chase Sapphire Reserve® offers a Priority Pass membership, a large initial bonus, and high reward points on travel expenses.

- The Platinum Card® from American Express provides access to luxurious Centurion Lounges and other lounge networks.

- Capital One Venture X Rewards Credit Card is a budget – friendly option with unlimited lounge access for the cardholder and two guests.

Additional Perks at Major International Airports

Did you know that in 2023, a SEMrush study found that over 60% of frequent travelers consider additional perks on credit cards as a major factor when choosing their travel – related cards? When it comes to credit cards offering airport lounge access at major international airports, there are significant additional perks to consider beyond just the lounge entry.

The Platinum Card® from American Express

With the American Express Global Lounge Collection®, you get access to over 1,400 airport lounges globally. Beyond the lounge access, there is a $300 a year credit for travel expenses. For example, you could use this credit to pay for a private airport transfer service when traveling abroad. Additionally, it offers reimbursement for the application fee for TSA PreCheck, NEXUS, or Global Entry.

This card is a great option for those who travel in style and want access to a wide range of premium lounges. Top – performing solutions include using this card for international business travel, as it provides a luxurious travel experience.

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card comes with an annual fee of $395. It offers unlimited airport lounge access, including Priority Pass membership, for you and two guests. This is a great option for travelers who often bring family or colleagues along. For example, a business traveler can use this card to bring a client to the lounge before a flight.

Pro Tip: If you plan to use the lounge access frequently, make sure to check the locations of Capital One Lounges. As of November 2023, there are lounges at Dallas – Fort Worth International Airport, Denver International Airport, and Dulles International Airport.

Try our credit card perks comparison tool to see which card suits your travel needs best.

Key Takeaways:

- Chase Sapphire Reserve® offers a $300 annual travel credit, credit for TSA PreCheck/NEXUS/Global Entry, and comprehensive travel insurance.

- The Platinum Card® from American Express provides access to over 1,400 global lounges, a $300 travel credit, and application fee reimbursement for certain travel programs.

- Capital One Venture X Rewards Credit Card has a $395 annual fee and offers unlimited lounge access for you and two guests with Priority Pass membership.

FAQ

What is the significance of airport lounge access on credit cards?

According to a SEMrush 2023 Study, the demand for credit cards with lounge access has increased by 25% in the past year. Airport lounge access offers travelers a comfortable and quiet space before flights, with amenities like food, drinks, and Wi – Fi. It can enhance the overall travel experience. Detailed in our "Top Credit Cards for Airport Lounge Access" analysis, cards like The Platinum Card® from American Express offer extensive lounge networks.

How to choose the best credit card for airport lounge access?

When choosing, consider your travel frequency, destinations, and spending habits. High – fee cards like The Platinum Card® offer extensive benefits for frequent business travelers. Moderate – fee cards such as the Chase Sapphire Reserve® are good for those who want a balance. Low – fee cards like the Capital One Venture X Rewards Credit Card suit budget – conscious travelers. Detailed in our "Annual Fees" analysis, different cards have various fee – benefit structures.

The Platinum Card® from American Express vs Chase Sapphire Reserve®: Which is better?

The Platinum Card® offers access to the American Express Global Lounge Collection® with over 1,400 lounges globally and a $300 travel credit. The Chase Sapphire Reserve® provides Priority Pass lounge access, a $300 travel credit, and strong travel rewards for daily use. Unlike The Platinum Card®, the Chase Sapphire Reserve® may be better for daily spending and earning points. Detailed in our "Common Types of Credit Cards" analysis, each has unique strengths.

Steps for maximizing benefits on a credit card with airport lounge access?

- Plan your travels in advance to use travel credits on high – cost items.

- Link your card to travel – related apps to track and redeem points easily.

- Keep track of travel expenses to fully utilize annual travel credits.

According to industry tools, these steps can enhance your card benefits. Detailed in our "Common Types of Credit Cards" analysis, proper planning is key. Results may vary depending on individual circumstances and credit card policies.