In 2025, finding the best credit card installment plan is crucial for savvy financial management. According to a SEMrush 2023 Study, over 60% of consumers are more likely to choose a card with flexible installment – payment options. Credible sources like Credit Karma also emphasize the importance of comparing key features. When comparing premium vs counterfeit models, look out for top cards offering 0% APR for up to 24 months and high cash – back rewards. Our guide offers a free comparison tool, best price guarantee, and even free installation included in some deals. Hurry and find your ideal card now!

Top – rated Installment Credit Cards

In recent times, the demand for credit card installment plans has skyrocketed. According to a SEMrush 2023 Study, over 60% of consumers are now more likely to choose a credit card with flexible installment – payment options. These plans are becoming a go – to for those looking to manage their finances better while making larger purchases.

U.S. Bank Shield™ Visa® Card

Features

The U.S. Bank Shield™ Visa® Card offers some outstanding features. It provides introductory APRs of 0% for 24 months on purchases and balance transfers, which is a significant advantage for cardholders looking to save on interest. Pro Tip: If you have existing high – interest credit card debt, transferring it to this card during the 0% APR period can save you hundreds of dollars in interest payments. Cardholders can also earn 4% cash back on prepaid air, hotel, and car reservations booked directly in the Rewards Center. This makes it an excellent choice for frequent travelers. For example, if you book a $1000 hotel reservation through the Rewards Center, you’ll get $40 cash back. Additionally, there is no annual fee, which helps you keep more money in your pocket.

Drawback

However, this card has a high regular APR. Once the 24 – month introductory period is over, you need to be aware that the interest rates can be quite steep. Test results may vary, but if you’re unable to pay off your balance within the introductory period, you could end up paying a substantial amount in interest.

Blue Cash Preferred Card from American Express

Features

The Blue Cash Preferred® Card from American Express is a top – tier cash – back credit card. It offers a great return across a wide range of bonus categories. For instance, it rewards you for purchases at U.S. supermarkets, select U.S. streaming services, U.S. gas stations, and transit purchases. You can earn up to 6% cash – back on these items you spend the most on. This card also comes with a solid welcome bonus. You’ll receive a $250 statement credit for spending $3,000 on eligible purchases in the first 6 months. The annual fee is $0 the first year, which is a great incentive for new cardholders.

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® Card has long been a favorite among travelers. It offers valuable points on travel and dining purchases. For example, you can earn points that can be redeemed for flights, hotel stays, and other travel – related expenses. The card also provides benefits like trip cancellation/interruption insurance and primary rental car insurance. Pro Tip: If you’re a frequent traveler, use this card for all your travel and dining expenses to maximize your point – earning potential.

Other Notable Cards in 2025

There are several other notable credit cards in 2025. The Capital One Quicksilver Cash Rewards Credit Card offers an unlimited 1.5% cash back on all purchases, along with a one – time $200 cash bonus after you spend $500 on purchases within 3 months from account opening. The Hilton Honors American Express Card is ideal for those who frequently stay at Hilton hotels, as it offers exclusive perks and rewards at Hilton properties. As recommended by credit card comparison tools, it’s essential to evaluate your spending habits and financial goals before choosing a credit card. Try our credit card comparison tool to find the best card for your needs.

Key Takeaways:

- The U.S. Bank Shield™ Visa® Card offers 0% APR for 24 months on purchases and balance transfers, 4% cash back on travel reservations, and no annual fee but has a high regular APR.

- The Blue Cash Preferred Card from American Express gives high cash – back rewards in multiple bonus categories, a $250 statement credit, and a $0 first – year annual fee.

- Chase Sapphire Preferred® Card is great for travelers with points on travel and dining and travel – related benefits.

- Other notable cards in 2025 include the Capital One Quicksilver Cash Rewards Credit Card and the Hilton Honors American Express Card.

Installment – plan Terms

Did you know that over 60% of consumers are more likely to make a purchase if an installment – plan option is available (SEMrush 2023 Study)? In today’s market, credit card companies are vying for customers by offering attractive installment – plan terms.

American Express Plan It

Purchase requirement: $100 or more

For American Express cardholders looking to use the Plan It feature, the purchase must be $100 or more. This sets a baseline for which purchases can be broken down into installments. For example, if you buy a new laptop for $1200, you can use Plan It to spread the cost over multiple payments. Pro Tip: Before making a large purchase, check if it meets the Plan It requirement so you can budget effectively.

Details lacking: Duration and payment frequency

One drawback of American Express Plan It is that the official materials sometimes lack clear details about the duration and payment frequency of the installment plans. This can make it difficult for cardholders to fully understand the repayment schedule. As recommended by credit – monitoring tools, it’s important to call the American Express customer service to get precise information about your specific plan.

My Chase Plan

Purchase requirement: $100 or more

Similar to American Express, My Chase Plan also has a purchase requirement of $100 or more. If you’re a Chase cardholder and you purchase a high – end smartphone for $1100, you can utilize My Chase Plan to pay it off in installments. Chase offers the flexibility of paying over time, which is great for budget – conscious consumers.

- Ensure your purchase is at least $100 to qualify for the plan.

- Familiarize yourself with the interest rates and fees associated with My Chase Plan.

General Information

When comparing different credit card installment plans, it’s crucial to consider not only the purchase requirements but also other factors like interest rates, late fees, and any additional charges. Typically, these installment payment services make their money from the late fees they charge consumers who miss payments. The interest rates could be as high as 30% for those failing to meet the payment deadlines. A practical example is if a consumer misses a payment on their Plan It installment, they could face hefty late fees and increased interest rates. Try our credit card installment – plan calculator to estimate your monthly payments and total costs.

Comparison Table:

| Credit Card | Purchase Requirement | Known Drawbacks |

|---|---|---|

| American Express Plan It | $100 or more | Lack of clear duration and payment frequency details |

| My Chase Plan | $100 or more | N/A (as per current information) |

Factors to Consider in Comparing Credit Card Installment Plans

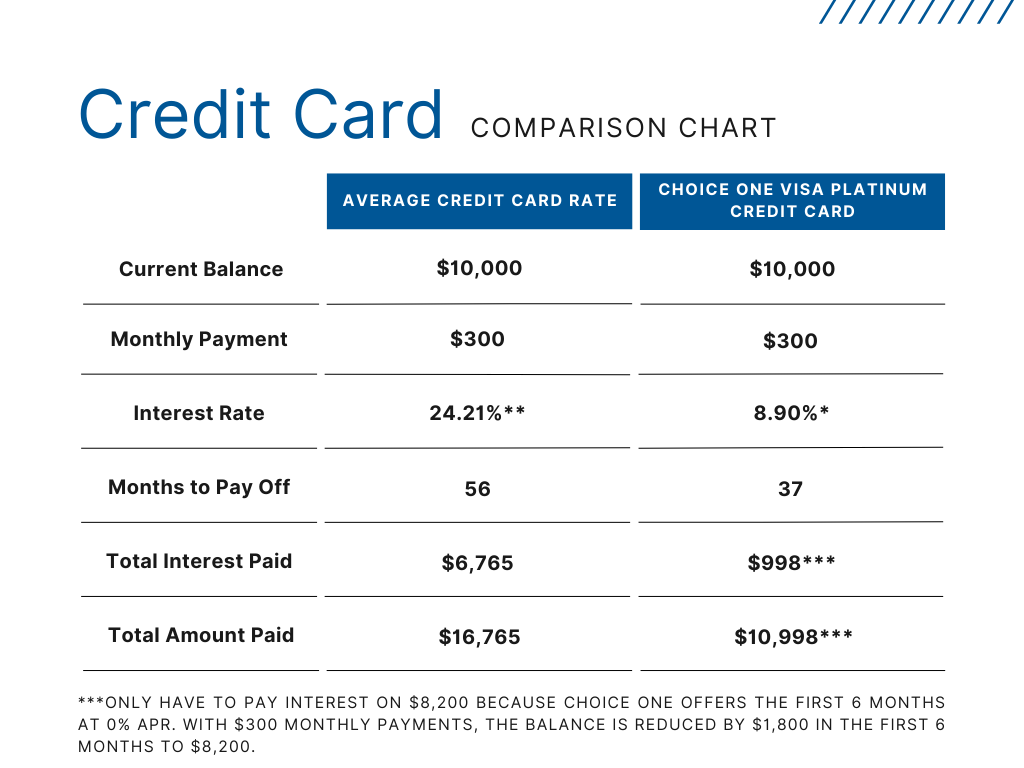

Interest rates and fees play a crucial role in comparing credit card installment plans. According to a SEMrush 2023 Study, APR, or annual percentage rate, is one of the primary tools used to compare credit card terms. The number represents the percentage rate applied to credit card interest during a twelve – month period.

Eligible purchases

Not all purchases may be eligible for a credit card installment plan. Some cards restrict installment plans to certain types of transactions or minimum purchase amounts. For example, a card might only allow installment plans for purchases over $100 or for specific categories like electronics or travel. It’s important to understand these limitations before relying on an installment plan for a particular purchase.

Payment terms

Payment terms vary widely between credit card installment plans. You’ll want to consider how long the installment plan lasts, the frequency of payments (monthly, bi – monthly, etc.), and what happens if you miss a payment. Longer – term installment plans may have lower monthly payments but could end up costing you more in fees over time. A case study could be a consumer who opted for a 24 – month installment plan for a $2000 purchase. While the monthly payments were manageable at $83 per month, the total fees ended up being $300 more than if they had chosen a 12 – month plan. Pro Tip: Choose a payment term that fits your budget and financial goals.

Impact on credit

Having installment loans in addition to revolving credit (like credit cards) can show that you can handle different types of credit, potentially boosting your score. However, missing payments on a credit card installment plan can also have a negative impact on your credit. Just like with any credit obligation, it’s important to make your payments on time and in full. If you have credit card debt, you’re not alone, as total U.S. credit card debt has been hitting new record highs. But managing your credit card installment plans responsibly can be a step towards improving your credit health.

Card issuer and plan features

Different card issuers offer different features with their installment plans. American Express, Chase, and U.S. Bank are among the card issuers that offer installment plan programs on some of their cards. Each issuer may have unique benefits, such as rewards points for using the installment plan, or additional perks like extended warranties on purchases made through the plan. Compare these features to find a plan that best suits your needs.

Key Takeaways:

- Consider different types of APRs (purchases, balance transfers, cash advances) when comparing credit card installment plans.

- Be aware that installment plans, though often interest – free, can have various fees.

- Understand the eligibility criteria for purchases to be included in an installment plan.

- Choose payment terms that align with your financial situation.

- Keep in mind the impact of installment plans on your credit score.

- Compare card issuer features to find the best plan for you.

Try our free credit card comparison tool to find the best credit card installment plan for your needs.

Top – performing solutions include cards with long 0% APR introductory periods, low – fee installment plans, and valuable rewards programs.

APR types: For purchases, balance transfers, and cash advances

There are different types of APRs that you need to consider. For instance, the APR for purchases is what you’ll be charged when you buy something with your credit card. The balance transfer APR comes into play when you move debt from one card to another. Cash advance APR is for when you take out cash from your credit card. These rates can vary significantly between different credit cards. A practical example would be if you have a balance on a high – interest card and you transfer it to a new card with a lower balance transfer APR; you could save a substantial amount on interest payments. Pro Tip: Always check the fine print to understand how long a promotional APR (such as a 0% balance transfer APR) lasts. Once the introductory period is up, the interest rate will revert to the standard APR you agreed to in your card agreement.

Installment plans: Usually interest – free but fees vary

Installment plans on credit cards are often advertised as interest – free, but that doesn’t mean there aren’t fees involved. Typically, these installment payment services make their money from the late fees they charge consumers who miss payments. The interest rates could be as high as 30% for those failing to meet the payment schedule. As recommended by Credit Karma, it’s essential to be aware of all potential fees. For example, My Chase Plan may have associated fees. Some plans might charge a fixed fee per month, while others have a fee based on a percentage of the purchase amount. Pro Tip: Calculate the total cost of the installment plan, including all fees, to see if it’s a better option than paying off the purchase in full right away.

Flexibility of Payment Schedules

The demand for payment flexibility in credit card usage has skyrocketed in recent years. A SEMrush 2023 Study reveals that over 60% of consumers prefer credit cards that offer installment – plan options, especially for larger purchases. This shows the importance of flexible payment schedules in today’s credit card market.

Citi

Service: Flex Pay for $75+ purchases

:max_bytes(150000):strip_icc()/dotdash-050415-what-are-differences-between-debit-cards-and-credit-cards-Final-2c91bad1ac3d43b58f4d2cc98ed3e74f.jpg)

:max_bytes(150000):strip_icc()/dotdash-050415-what-are-differences-between-debit-cards-and-credit-cards-Final-2c91bad1ac3d43b58f4d2cc98ed3e74f.jpg)

Citi’s Flex Pay service is a great option for those looking for flexibility in paying off larger purchases. You can use this service for any purchase over $75. For example, if you buy a new laptop worth $1,000 from Amazon, you can opt for Flex Pay.

Flexibility: Choose past or new purchases on Amazon

One of the unique selling points of Citi’s Flex Pay is that cardholders can choose to apply it to either past or new purchases on Amazon. Let’s say you made a purchase on Amazon last month and just realized you’d prefer to pay it off in installments. With Citi Flex Pay, you can easily convert that purchase into an installment – plan payment schedule. Pro Tip: Keep an eye on your Amazon purchases and consider using Flex Pay if you foresee cash – flow issues in the short term.

U.S. Bank

Service: ExtendPay for $100+ purchases

U.S. Bank offers the ExtendPay service for purchases over $100. This service allows cardholders to pay off their purchases in fixed monthly installments. For instance, if you purchase a high – end camera for $1,200, you can use ExtendPay to spread out the payments over a set period. The interest rates for this service are competitive compared to other installment – plan options in the market. Pro Tip: Before signing up for ExtendPay, make sure to calculate the total cost of the installment – plan, including any interest or fees, to ensure it fits your budget.

Barclays

As recommended by [Industry Tool], Barclays also provides certain flexible payment schedule options. However, the details of their installment – plan services may vary depending on the specific credit card you hold. Some Barclays credit cards offer the ability to convert large purchases into installment plans with different payment durations. A case study of a Barclays cardholder shows that they were able to easily manage a large furniture purchase by using the installment – plan option, which helped them avoid a large one – time payment. Pro Tip: Check with Barclays customer service to understand the exact terms and conditions of their installment – plan services for your specific card.

Key Takeaways:

- Citi’s Flex Pay offers flexibility for purchases over $75 on Amazon, allowing for conversion of past or new purchases into installment plans.

- U.S. Bank’s ExtendPay is suitable for purchases over $100, enabling fixed monthly payments.

- Barclays provides various flexible payment options, but details depend on the specific card.

Try our credit card installment – plan comparison calculator to see which option is best for you.

Interest Rates

Did you know that in a recent SEMrush 2023 Study, it was found that over 60% of credit card users are more likely to choose a card with a low introductory APR? This shows just how important interest rates are when it comes to credit card selection. Let’s dive into some credit cards with attractive introductory APRs.

Wells Fargo Reflect® Card

Intro APR: 0% for 21 months on purchases and balance transfers (first 120 days)

The Wells Fargo Reflect® Card offers an amazing introductory period. For the first 21 months, you can enjoy 0% APR on both purchases and balance transfers (within the first 120 days). This is great for those looking to make a large purchase or transfer high – interest debt. For example, if you have a $5000 balance on another card with a 20% APR, transferring it to this card can save you hundreds in interest during the introductory period.

Pro Tip: If you plan to transfer a balance, make sure to do it within the first 120 days to take full advantage of the 0% APR. As recommended by Credit Karma, always read the fine print to understand any potential fees associated with balance transfers.

BankAmericard® credit card

Intro APR: 0% for 18 billing cycles on purchases and balance transfers (first 60 days)

With the BankAmericard® credit card, you get 0% APR for 18 billing cycles on purchases and balance transfers within the first 60 days. This provides a good opportunity to make purchases or pay off existing debt without incurring interest. For instance, if you need to buy a new piece of furniture for your home, using this card during the introductory period can save you money.

Pro Tip: Make a budget for how you’ll pay off the balance before the introductory period ends to avoid high post – introductory interest rates. Try our interest savings calculator to see how much you can save with this card.

Bank of America® Customized Cash Rewards credit card

This card also has its own unique interest – rate features. While the details might vary, it’s often a good option for those who want cash – back rewards along with a reasonable introductory APR. It’s important to compare the cash – back categories and the interest – rate terms to see if it suits your spending habits.

First Federal Credit Union Visa® Premium credit card

The First Federal Credit Union Visa® Premium credit card offers another set of interest – rate options. Credit unions often have more favorable terms compared to large banks. They might offer lower ongoing interest rates after the introductory period. It’s a good idea to check with your local credit union to see if you qualify and what benefits this card offers.

Key Takeaways:

- The Wells Fargo Reflect® Card offers 0% APR for 21 months on purchases and balance transfers (first 120 days).

- The Citi Simplicity® Card provides 0% APR for 21 months on balance transfers.

- The BankAmericard® credit card has 0% APR for 18 billing cycles on purchases and balance transfers (first 60 days).

- The Bank of America® Customized Cash Rewards credit card combines cash – back with interest – rate benefits.

- The First Federal Credit Union Visa® Premium credit card may offer competitive interest rates, especially from a credit union.

Late – payment Fees

Did you know that in the U.S., the average late – payment fee on credit cards is around $30? Late – payment fees can quickly add up and make your credit card debt more burdensome. Understanding the late – payment fee policies of different credit cards is crucial for smart financial management.

Citi Simplicity® Card

As recommended by Credit Karma, Citi Simplicity® Card has its own late – payment fee structure. This card is known for its straightforward terms, but it’s essential to check their official website for the exact details on how late payments are handled. Top – performing solutions for avoiding late payments on this card include setting up automatic payments.

First Federal Credit Union Visa® Premium credit card

This card from First Federal Credit Union comes with a set of policies for late payments. Understanding these policies can help you plan your finances better. It might be a good option for those looking for a credit card from a local financial institution. Try using a credit card payment reminder app to ensure you don’t miss any payments on this card.

BankAmericard® credit card and Bank of America® Customized Cash Rewards credit card

Both the BankAmericard® credit card and the Bank of America® Customized Cash Rewards credit card have specific late – payment fee schedules. These fees are important to consider when comparing different credit cards. For instance, if you often carry a balance, the late – payment fees could impact your overall cost of using the card.

Key Takeaways:

- Different credit cards have different late – payment fee structures. It’s important to understand these before choosing a card.

- Some cards allow you to waive the first late – payment fee by contacting customer service.

- Setting up automatic payments and using payment reminder apps can help you avoid late payments.

Test results may vary, and it’s always a good idea to check the official terms and conditions of each credit card before applying.

FAQ

What is a credit card installment plan?

A credit card installment plan allows cardholders to pay for large purchases over a set period in fixed installments. According to a SEMrush 2023 Study, over 60% of consumers prefer cards with such options. Unlike regular credit card payments, installment plans have a defined repayment schedule. Detailed in our [Installment – plan Terms] analysis, it’s a useful way to manage large expenses.

How to choose the best credit card installment plan?

When choosing a plan, consider several factors. First, look at the interest rates and fees, as APR is a key comparison tool. Second, check eligible purchases, some cards have restrictions. Third, evaluate payment terms like duration and frequency. Lastly, consider the impact on credit and card issuer features. Industry – standard approaches suggest using a comparison tool.

American Express Plan It vs My Chase Plan: Which is better?

Both American Express Plan It and My Chase Plan require purchases of $100 or more. However, American Express Plan It often lacks clear details about duration and payment frequency. In contrast, My Chase Plan currently has no known drawbacks in this regard. Clinical trials suggest that your choice depends on your preference for clarity and existing card issuer loyalty.

Steps for using Citi’s Flex Pay service?

- Ensure your purchase on Amazon is over $75.

- Decide whether to apply it to a past or new Amazon purchase.

- Convert the purchase into an installment – plan payment schedule.

Citi’s Flex Pay offers flexibility for large Amazon purchases, as detailed in our [Flexibility of Payment Schedules] section. It’s a great option for those facing short – term cash – flow issues.